What Is An I bond?

May 24, 2022

Jackie Mazur on Paving Her Own Way In Finance – SheEO Podcast with Rebecca Jones

May 26, 2022Economic Update May 2022

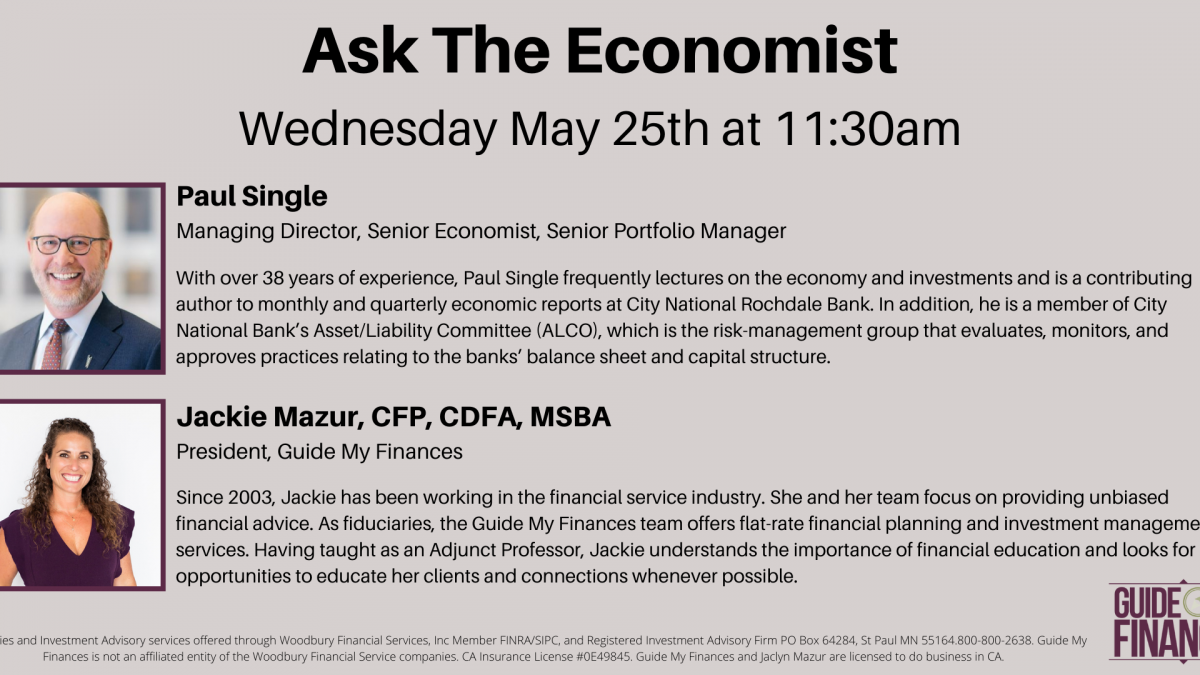

On Wednesday, we hosted an Ask the Economist webinar to help answer some questions about what is happening currently and what we can expect in the months and years to come. In addition to being able to access the recording below here is a brief summary from our call.

Labor:

Our labor market is strong. We have more job openings than we have looking for work. While there may be some turnover in certain industries, the period of unemployment will likely be minimal due to pent up demand for employees.

Consumption:

Over the last two years households have been spending more on goods which has increased demand and, as a result, prices. Now that the lockdown is over and we have acquired all the goods we could need, households are shifting their spending to services including restaurants and travel.

Household Finances:

Bank deposits are the highest we have seen in years resulting in $4.5 trillion more in cash than before the 2020 recession. In addition, household debt is at an all-time low. While prices are increasing, we can afford to pay for it right now.

Housing:

Housing prices have grown dramatically over the last two years. People are moving to less expensive areas to find cheaper housing. Inventory is low, and the pace of new home building is not keeping up with demand. Institutional buyers and individual buyers are purchasing rental properties which is also reducing the number of homes available. Housing growth makes up 40% of the current inflation rate, so the fed is trying to slow this down and calm the housing market to calm inflation. While interest rates are rising, making mortgage costs more expensive, it will likely take 1-3 years for the housing market to settle down.

Inflation:

Most inflation peaks have materialized through geopolitical unrest. The inflation we have seen is primarily an increase in the cost of goods, and less of a cost of services. Once supply chain constraints are resolved, the price of goods should start to settle. The expectation is that inflation will decline to 4.3% by the end of Q1 2023.

Energy:

Energy prices are high and will likely stay high for some time. Supply is low and production is below pre-pandemic levels. Historically, we have spent 3.6% of our spending on energy. Today, we are spending closer to 3%, so while prices are high, the energy consumption efficiencies have reduced the overall amount we use, ultimately keeping our spending levels consistent with historical averages.

The Fed:

Interest rates will continue to rise through the end of the year. They are currently still at historic lows but are creeping towards average territory.

Click HERE To Listen to the playback